Here's a fun fact: A 1% improvement in how you monetize can lead up to a 12.7% increase in profit. And a well run pricing strategy? It's up to 7.5x more effective at generating growth than acquisition strategies alone.

Choosing the right SaaS pricing model isn't a spreadsheet exercise. It's a strategic lever that demands alignment between product, market, and momentum. The stage you're in, the value you deliver, the way your users scale — everything assembles in a single number which defines your story.

If you don't have a pricing strategy in place, revenue is leaking with every new signup and you're leaving huge money on the table. Defining how you charge is one of the most important decisions you'll ever make in order to shape revenue, investors confidence, and long-term growth.

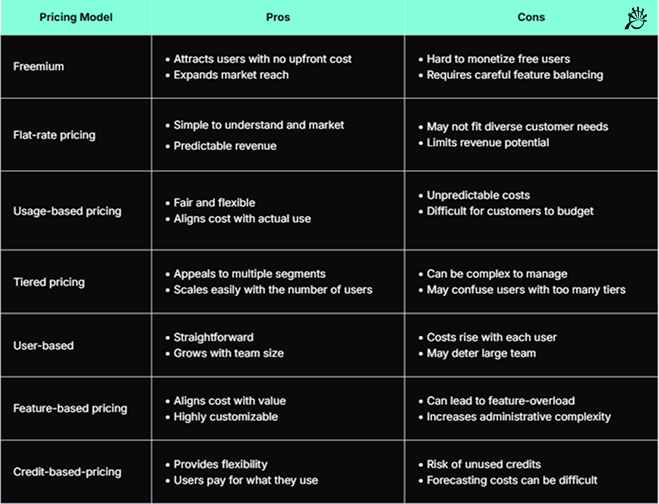

This guide compares SaaS pricing models and strategies and highlights the differences between them. Let’s break down what works, why it works, and how to as you scale.